b&o tax credit

The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas. A reduced tax credit would apply to gross earnings up to nearly double that amount.

747 8f Rollout Of Everett Factory Boeing Aviation Blog Aviation

Take the credit against your Tacoma BO taxes each year and attach aJob heet.

. You can get a 500 BO tax credit every year for five years if you. The Small Business Tax Credit 720 applies if. Small Business B.

Dditional credits are available of up to 1000 every year. This credit is commonly referred to as the small business BO tax credit or small business credit SBC. 500 Base Credit - Qualifying Position.

If youre in the manufacturing category you wont have to pay B O tax until your annual income is at about 86000 with a sliding scale after that. A business and occupation BO tax credit is available to businesses that employ an unemployed veteran in a permanent full-time position located in Washington for at least two consecutive full calendar quarters on or after October 1 2016 and before June 30 2022. Get an extra 500 BO tax credit if the employee that fills the new position is a Tacoma resident.

The amount of small business BO tax credit available on a tax return can increase or decrease depending on the reporting frequency of the account and the. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization. Jerry Seinfelds movie about the creation of the Pop Tart is among 30 movies in line to receive California state tax credits committing to spend about 12 billion in Los Angeles and statewide.

There are two credits available under the Small Business Tax Credit depending on your taxable income and total BO tax liability. The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. NFIB supports the bill.

The small business tax credit is broken up based on how often you file as follows. Eligible Main Street organizations can receive first quarter donations totaling up to 18518518. Write the amount on page 2 line 73 of the Combined Excise Tax Return.

The major BO tax credits are. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Basic Facts About the BO Tax Credit Program.

Rural County B. Because Sumner Main Street Association is a 501 c 3 non-profit organizations other tax incentives may apply. The federal tax credit for high-efficiency HVAC equipment applies to Energy Star-certified systems.

High Technology B. NFIBs state director and its Leadership Council vice chair Lois Cook testified in favor of the bill February 24. A new application must be submitted to the.

Get an extra 250 BO tax credit if the position meets the definition of a. Credits are subtracted from the BO tax due on your excise tax return. Multiple Activities Tax Credit MATC.

That means if you expand your workforce in Tacoma you can get a credit against the BO tax of up to 1500 annually. The Washington State Department of Revenue Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to Main Street Coupeville Historic Waterfront Association. Credit definitions provide detailed instructions for reporting credits on the tax return.

If you owe beneath a certain level you pay zero tax. If your total BO tax due is less than 421 the Small Business BO Tax Credit will be equal to that amount. Government currently offers a tax credit to homeowners who install high-efficiency heating and cooling equipment.

Please call the SMSA office at 253 891-4260 or email us. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. 71 for monthly taxpayers 211 for quarterly taxpayers and 841 for annual tax payers.

Read across to the next column. 50 or more of your taxable income was reported under Service and Other Activities Gambling Contests of Chance For-Profit Hospitals andor Scientific RD and. Locate the total BO tax due in the table above.

As your company becomes more profitable the scale slides upward. The Small Business BO Tax Credit is applied on a sliding scale that depends upon the amount of tax you owe. Full-Time Employees For a full-time employment position to be eligible for credit it must be requested by application before the new position is filled.

This is the amount of your Small Business BO Tax Credit. Businesses must be registered to file their state BO tax electronically. The bill would increase the small-business BO tax credit to effectively exempt the first 125000 in gross receipts for all qualifying businesses.

Check with your accountant for further details. The payments had a. Energy Star-certified gas furnaces quality for a.

A request for credit must be filled out and submitted online at wwwdorwagov. BO Tax Credit Program Direct your tax dollars back into your community Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization.

Energy Star-certified central air conditioners and heat pumps quality for a 300 tax credit. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or fraction thereof of delinquency and one percent 1 of the tax for each succeeding month or fraction thereof of delinquency. A pledge of 1000 equals a tax credit of 750 that will be applied to your 2023 B O tax obligation.

1 day agoThe balance of the credit is to be paid as tax refunds when families file their federal income tax returns between now and April 18. The 30 projects for which the Commission has reserved 1492 million in tax credit allocations include 19 indies and 11 studio films four of which Atlas Beverly Hills Cop 4 Unfrosted and. Since the city implemented the 2-per-week User Free in January 2020 establishing what businesses employed 25 or fewer workers and would qualify for the first-quarter tax credit was completed quickly and the number of business owners not current with their BO taxes was calculated as well.

Add a new full-time 35 or more hoursweek job to your Tacoma workforce.

Chesapeake Ohio Railroad Herald Yellow Railroad Railroad Photography Baltimore And Ohio Railroad

Cn 4 8 4 At Hamilton Junction Classic Trains Magazine Train Train Engines Steam Trains

B O Tax Credit Program Puyallup Main Street Association

Pinterest Baltimore And Ohio Railroad Railroad Pictures Railroad Photography

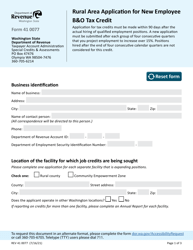

Form Rev41 0077 Download Fillable Pdf Or Fill Online Rural Area Application For New Employee B O Tax Credit Washington Templateroller

C O Power Train Posters Old Trains Lionel Trains

Prr 1361 At Bay Head Nj Steam Locomotive Locomotive Pennsylvania Railroad

P Wv Rr Pennsy Pennsylvania Rail Road P Wv Pittsburgh And West Virginia Pennsylvania Railroad Railroad Logo Sign

New York Central Railroad Train Sticker Decal R714 You Choose Size Ebay New York Central Railroad New York Central Train Posters

B O Tax Credit Program Sumner Main Street Association

B O Tax Credit Incentive Program Downtown Waterfront

Straight Talk Prepaid Apple Iphone 6 32gb Space Gray Limit 2 Sales Of Prepaid Phones Are Restricted To No More Th Apple Iphone 6 Prepaid Phones Apple Iphone

Main Street Tax Credit Program In Washington

Chessie System Porcelain Sign 10 20 Porcelain Signs Train Railroad Art